Section 2: Notice of Direct Debit (U.S. Treasury Check Reclamation)

Introduction

All check reclamations are sent to the presenting bank via a Notice of Direct Debit (U.S. Treasury Check Reclamation). This notice will advise the presenting bank of the amount demanded and the reason for the demand; it will also contain instructions for processing the Notice of Direct Debit (U.S. Treasury Check Reclamation).

The presenting bank will receive:

- An initial Notice of Direct Debit (U.S. Treasury Check Reclamation); and as necessary

- A Summary of Debt Statement.

The Notice of Direct Debit (U.S. Treasury Check Reclamation), the Summary of Debt Statement and other related check reclamation reports are generated by the Bureau of the Fiscal Service (Fiscal Service) and transmitted through FRB FedMail to the presenting bank.

This section consists of the following topics:

- The Notice of Direct Debit (U.S. Treasury Check Reclamation),

- How to Respond to the Notice of Direct Debit (U.S. Treasury Check Reclamation),

- Summary of Debt Statement, and

- Reclamation Status Codes.

Notice of Direct Debit (U.S. Treasury Check Reclamation)

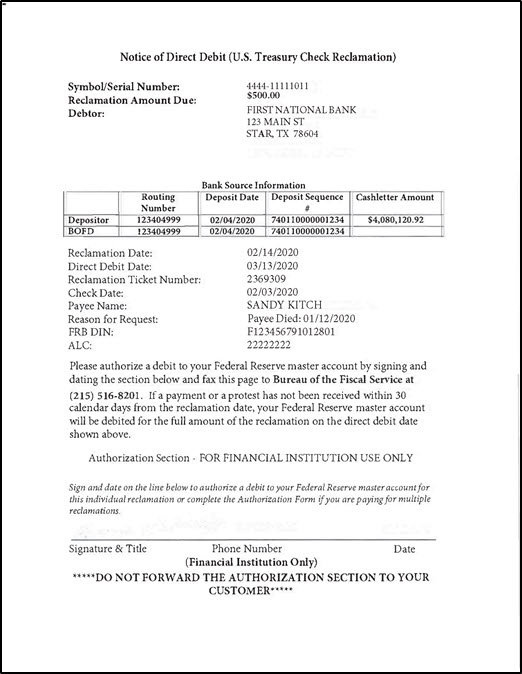

Below is a sample of the Notice of Direct Debit (U.S. Treasury Check Reclamation):

Purpose

The Notice of Direct Debit (U.S. Treasury Check Reclamation) is the initial notice sent to the presenting bank advising it of the amount requested and reason for the reclamation action. A copy of the payee's claim, if applicable, will be included with the Notice of Direct Debit (U.S. Treasury Check Reclamation). Note: If Fiscal Service furnishes a sequence number and deposit date, then a check image will not be provided.

How to Respond to the Notice of Direct Debit (U.S. Treasury Check Reclamation)

Response Time:

Presenting banks have 30 calendar days from the date of the Notice of Direct Debit (U.S. Treasury Check Reclamation) to make full payment or submit a protest to Fiscal Service to avoid the direct debit on their Federal Reserve master account. Fiscal Service will automatically process the Direct Debit on the 31st day if no protest has been entered.

Procedure

The table below shows how the financial institution should respond to a Notice of Direct Debit (U.S. Treasury Check Reclamation).

Table may scroll on smaller screens

| Step | Action |

|---|---|

| 1 |

|

| 2 |

|

| 3 |

|

| 4 |

|

Summary of Debt Statement

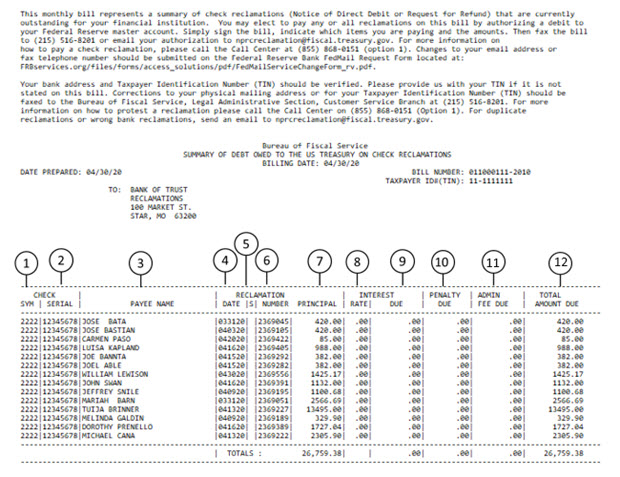

Sample

Purpose

The Summary of Debt Statement is a follow-up notice sent to the presenting bank on a monthly basis. It includes the following for each outstanding reclamation listed on a Notice of Direct Debit (U.S. Treasury Check Reclamation) previously sent to that bank:

- Identifying check information,

- Reclamation information,

- Additional charges associated with the reclamation (interest, penalties, and administrative fees), when applicable, and

- Status of reclamation.

Multi-part form

The Summary of Debt Statement consists of the following parts:

- Listing of outstanding reclamation(s) and associated information,

- An explanation of authorities and Fiscal Service processes regarding reclamations, protests, and collections, and

- Explanation of columns on the Summary of Debt Statement.

Column explanation

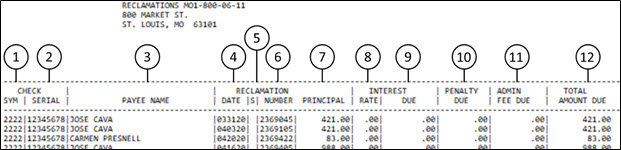

The table below describes the type of information included in each column on the Summary of Debt Statement.

Table may scroll on smaller screens

| Reference No. | Column | Explanation |

|---|---|---|

| 1-2 | Check Sym/Serial | Check Symbol number and Check Serial number appearing on the check for which there is a reclamation action. |

| 3 | Payee Name | Name of the person to whom the check was issued for which there is a reclamation action. |

| 4 | Reclamation Date | Date shown on the Notice of Direct Debit (U.S. Treasury Check Reclamation). |

| 5 | Reclamation Status Code | Headed with the designation of "S" on the Summary of Debt Statement Current status of the reclamation by code. Refer to Reclamation Status Codes.) |

| 6 | Reclamation Number | Request number which appears on the Notice of Direct Debit (U.S. Treasury Check Reclamation). |

| 7 | Reclamation Principal | Reclamation amount due which appears on the Notice of Direct Debit (U.S. Treasury Check Reclamation). |

| 8 | Interest Rate | Interest rate being charged on the item because it has remained unpaid for over 60 days. Note: The rate of interest assessed is the rate of the current value of funds of the U.S. Treasury. Although the interest rate varies, the initial rate charged on reclamation is the rate that remains until it is paid. |

| 9 | Interest Due | Amount of interest due per item as of the current Summary of Debt Statement. |

| 10 | Penalty Due | Penalty charges due per item as of the current Summary of Debt Statement. Note: Penalty is calculated at 6% per annum and does not vary. It is assessed at the 91st day. |

| 11 | Admin Fee Due | Administrative fee due per item as of the current Summary of Debt Statement, if applicable. The amount is based on the cost to the U.S. Federal Government for the collection of delinquent items. |

| 12 | Total Amount Due | Total of the:

|

Reclamation Status Codes

Introduction

Items appearing on the Notice of Direct Debit (U.S. Treasury Check Reclamation) that have been protested may be annotated by the letter B in the Reclamation Status column on the Summary of Debt Statement.

Codes

The list below shows the reclamation status codes and what each code means when it is used on the Summary of Debt Statement.

- CODE A IDENTIFIES items at least 90 calendar days old

- Items will become eligible for an Administrative Offset, also known as an Offset, at 120 calendar days if payment is not received by Fiscal Service prior to the 25th calendar day of the month in which the Summary of Debt statement is received.

- CODE B IDENTIFIES items for which a protest is being considered.

- This code will remain on the statement until the protest is resolved. Pending written notification from Fiscal Service responding to your financial institution's request, collection efforts, including offset, will be held in suspension.

- CODE C IDENTIFIES a Reclamation and/or accrued interest, penalty charges, and administrative fees that have remained unpaid for at least 120 days after the reclamation date.

- Fiscal Service has referred or will refer the debt to the Treasury Offset Program (TOP) and/or to another Federal entity for offset of Federal payments payable to your financial institution to collect the debt owed. If the debt is not collected through an administrative offset, Fiscal Service will initiate Treasury Check Offset (TCO), whereby Fiscal Service directs the Federal Reserve Bank to offset credits for Treasury checks presented for payment by your financial institution. The offset credits will be applied to the debt owed by your financial institution.